Investors

Discover investment opportunities in an R&D&i company through our capital rounds.

Financing round Open

Capital increase round OPEN until 30/09/2024. Minimum target: €2,000,000.

Here you will find all essential information and instructions to participate directly in the capital increase round open until 30/09/2024. If you have any questions or need more information, you can email inversores@pharmameldrugdiscovery.com

New shareholders

- Priceper share: The price of shares is €92.68 until September 30th, inclusive. The price will always be €74.14 per share for investments exceeding €25,000.

- Minimum investment: €1,019.48 at €92.68 per share, totaling 11 shares.

- Deposit/transfer for the desired amount, until September 30th.

How to make the investment?

1) Deposit/transfer for the desired amount by September 30th to the following account:

- Account holder: PHARMAMEL S.L.

- Reference: Capital increase

- Bank: BANCO SANTANDER

- Account number (IBAN): Request from investors@pharmameldrugdiscovery.com

Send an email to inversores@pharmameldrugdiscovery.com with the COPY or PROOF of the bank transfer and the following information:

Individuals

- Name and surname

- ID/Passport

- Date of birth

- Nationality

- Full postal address

- E-mail address

- Phone

- Occupation

- Marital Status and Regime in case of marriage

- Securities Deposit Account Number and Bank (for potential future IPO)

Companies

- Company name

- Vat Number

- Full postal address

- E-mail address

- Phone

- Registration data (Commercial Register of XXXXX, Volume XXXX, Folio XXXX, Sheet No. XXXX)

- Contact person

- Contact e-mail address

- Phone

- Securities deposit account number and bank (for potential future IPO).

3) On behalf of Pharmamel Drug Discovery, once the contribution is received, we will provide you with a confirmation of the transfer received for registration and as soon as the capital increase is closed, a copy of the deed of capital increase.

Financial and project information

1. Current status

First, we include a video explaining our pharmaceutical product (melatonin injectable) which is in phase IIB/III and phase III of the clinical study.

After conducting two Phase II clinical trials and successfully demonstrating the safety and efficacy of the drug, the company has the perfect drug candidate. However, Pharmamel must now proceed with the development of the Phase IIB/III clinical trial and obtain marketing authorization from the EMA and the FDA for its subsequent licensing to the pharmaceutical industry.

Over the 10 years of the company’s life, several capital increases have been carried out to finance the project, and after exhausting the investment capacity of the partners themselves, as well as small private investors, in the last fiscal year 2023, Pharmamel prepared to undertake a new external capital increase campaign, thus resorting to the crowdfunding platform regulated by the CNMV Capital Cell, managing to raise 1,600,000 € in this capital increase round at a pre-money valuation of 31,000,000 €.

Following the successful capital increase round conducted on the CNMC-regulated platform, Pharmamel’s project gains the support of more than 450 new shareholders specialized in biotechnology, as well as positive evaluations from:

An independent and exclusive network of experts in the life sciences and investment industries. Only proposals that receive positive responses in innovation, science, and finance successfully advance to the Capital Cell funding campaign stage.

An industrial property (IP) agency, whose European patent agents assess the IP of companies that approach Capital Cell, and only those with satisfactory protection and freedom to operate are approved for funding.

An international consultancy that provides a set of integrated services designed to assist companies in the healthcare and life sciences sectors. Its market access and regulatory team evaluates each project, and only those approved are financed through Capital Cell.

Currently, Pharmamel has a drug candidate ready to initiate a phase IIB/III clinical trial. This development entails a new corporate and investment strategy, both technological and human, which requires a new financial proposal for Pharmamel.

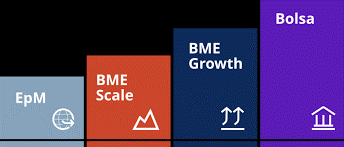

After demonstrating the effectiveness, efficacy, and safety of the new drug in clinical trials for sepsis and Covid-19 (bacterial and viral sepsis), the international regulatory affairs and CRO consultant Veristat has developed a regulatory strategy and road map for Pharmamel to obtain drug registration with the EMA and FDA. Following the promising results obtained in the two phase II clinical trials, industrial protection, and technological advancement, an independent valuation of Pharmamel was conducted by Axispharma, an independent company specializing in biotech firms. According to this analysis, Pharmamel is valued at 130 million euros, and after applying a safety margin discount, the company’s valuation stands at 65 million euros. After analyzing the situation and various financial alternatives, Pharmamel has initiated the process to list on the BME Scaleup, by signing a strategic agreement with the registered advisor Armanext and entering the pre-market environment of BME. With Pharmamel’s IPO, the company will be significantly strengthened by:

-

Visibility, strategic positioning, and internationalization of Pharmamel for future licensing operations.

-

Obtaining/raising the necessary resources in the short term.

-

Exit opportunity for new and current shareholders.

Following the success of the last capital increase round conducted on Capital Cell, Pharmamel currently has sufficient resources to begin the listing process and initiate the early stages of the phase IIB/III clinical trial.

2. Pre-IPO: Current capital increase round 2024

Capital Cell/Retail Campaign

- Pre-money valuation: €37,000,000.

- Maximum campaign target: €5,000,000.

- Optimal campaign target: €4,000,000.

- Campaign target: €2,000,000.

Institutional Investor Campaign

- Pre-money valuation: €37,000,000.

- Maximum target for the campaign: €6,000,000.

- Optimal target for the Capital Cell campaign: €4,000,000.

- Capital Cell campaign target: €3,000,000.

At this moment, Pharmamel is at a key stage in its growth and development, both corporately and scientifically, as the company has begun the process to list on BME Scaleup by signing a strategic agreement with the registered advisor Armanext and entering the pre-market environment of Bolsa y Mercados Españoles (BME), where Pharmamel is expected to go public in the fourth quarter of 2024. On the scientific front, the company faces the significant challenge of completing an international, multicenter phase IIB/III clinical trial. Conducting this trial represents an important inflection point of value for Pharmamel, as obtaining positive results in this phase IIB/III trial, in addition to the excellent results obtained in phase 2 studies, will likely grant Pharmamel and its shareholders an increase in the valuation of the listed company, and the potential pre-licensing of the new intravenous melatonin injectable and the monetization of the drug with the likely “Fast Track” application. To fully finance the phase IIB/III clinical trial in Europe and the USA in accordance with EMA and FDA regulations and bring the drug to market, Pharmamel is launching a new pre-IPO capital increase round on Capital Cell, a platform regulated by CNMV, at a pre-money valuation of €37,000,000 before going public on BME Scaleup with an estimated initial listing valuation of €45,000,000.

This round is expected to be complemented by CDTI, NextGenerationEU, ENISA, and other grants for which the company has already applied, in addition to the participation of private and specialized investors, as well as public-private investment funds, with which the company has already signed pre-investment agreements/LOI, within a period of 6 to 12 months. This pre-IPO capital increase includes both retail investors through the CNMV-regulated platform, Capital Cell, as well as institutional investors, family offices, and venture capital firms. Once this capital increase round (with a minimum target of €2,000,000) is completed, the company plans to list on BME Scaleup by the end of 2024. The decision to go public is not only aimed at positioning the company but also at offering transparency, visibility, and reputation, as well as providing a clear exit route for investors and the opportunity to raise capital in financial markets. It is important to note that Pharmamel’s corporate strategy is not simply limited to listing on BME Scaleup; rather, the IPO is considered a tool and not an end in itself. Therefore, Pharmamel’s corporate plan includes the ambition to scale to the next level of the stock market, specifically to BME Growth or Euronext Access by 2026. This timeframe is strategically selected, as by then, Pharmamel will have completed and obtained the results of the first clinical phase of phase III trials, which will presumably increase the company’s valuation and open up the possibility of licensing or pre-licensing its technology to the pharmaceutical industry. With these significant events, the corporate strategy consists of scaling to the next level of the stock market, either by transitioning to BME Growth or by listing on the European market, Euronext.

Institutions and entities collaborating with the Pharmamel Drug Discovery project

Other Relevant Information

- Investment DeckDownload our investor presentation (ES)

Shareholder and investor relations

Welcome to our shareholders’ area. Here you will find updated information about the company’s stocks and finances. You can download and review meeting documents and shareholder agreements.

Invest

Would you like to become a shareholder in our company? We are eager to work with private investors and institutions through our listing on the stock market.

We are open to discussing partnership opportunities globally, as well as potential collaborations with strong and motivated business and development partners in specific markets such as the USA, Europe, China, Russia, or Mexico, where we hold strong intellectual property rights for this product. We are also considering partnership and investment opportunities for other melatonin-based products in our development pipeline.

If you are interested in investing or partnership opportunities, please contact us at info@pharmameldrugdiscovery.com